2026 Rate Changes - Massachusetts: +13.8% avg; "significant" portion due to IRA subsidy expiration (preliminary)

Via the Massachusetts Division of Insurance:

Merged Market Summary for Proposed Rates Effective for 2026

The following tables depict the proposed overall weighted average premium increase and the key assumptions behind premium development for the merged (individual and small employer) market filed by insurance carriers as part of the Massachusetts Division of Insurance rate review process (for rates effective in 2026). This information is subject to change as the rate review process continues.

The Health Care Access Bureau within the Massachusetts Division of Insurance is currently reviewing these assumptions. This review process will culminate in a final decision in August 2025.

There are 711,563 consumers enrolled in merged (individual/small group) market plans (data as of December 2024).

The Average Rate Change represents adjustments to reflect benefit changes in renewing plans and it reflects plans that have been terminated and mapped to existing plan offerings. This weighted average rate change represents the average rate change consumers will experience before changes due to age.

The Medical Expense and Pharmacy Trend Assumptions are the annualized rate of increase due to increases in the unit cost of health care services and in the utilization of health care services.[1] These trend assumptions are generally applied to current claims experience to project 2026 required revenue rates.

The Non-Medical Portion of Premium represents the percent of overall premium that is required to cover administrative expense, contribution to reserves and required taxes and fees, including premium tax, ACA fees.

The Risk Adjustment Assumption is the Affordable Care Act’s (ACA) risk adjustment program which redistributes funds from carriers with lower-risk enrollees to plans with higher-risk enrollees.

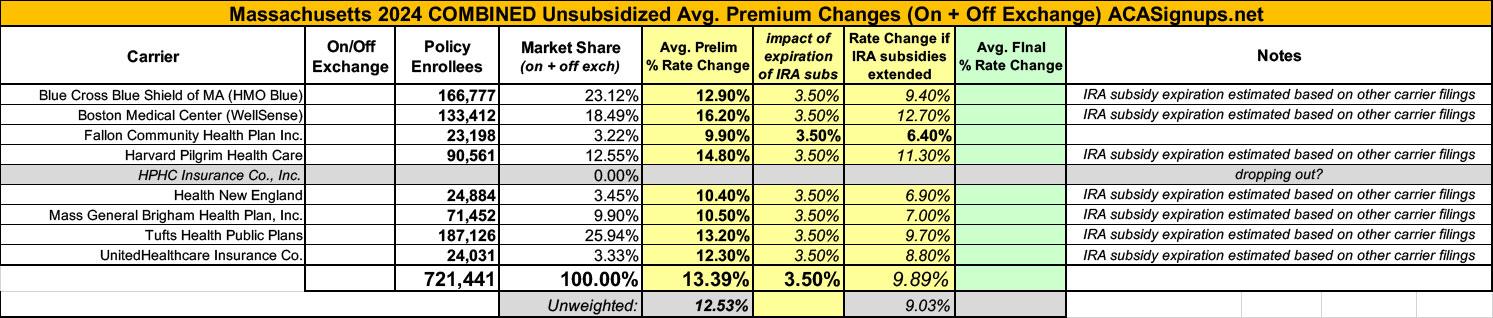

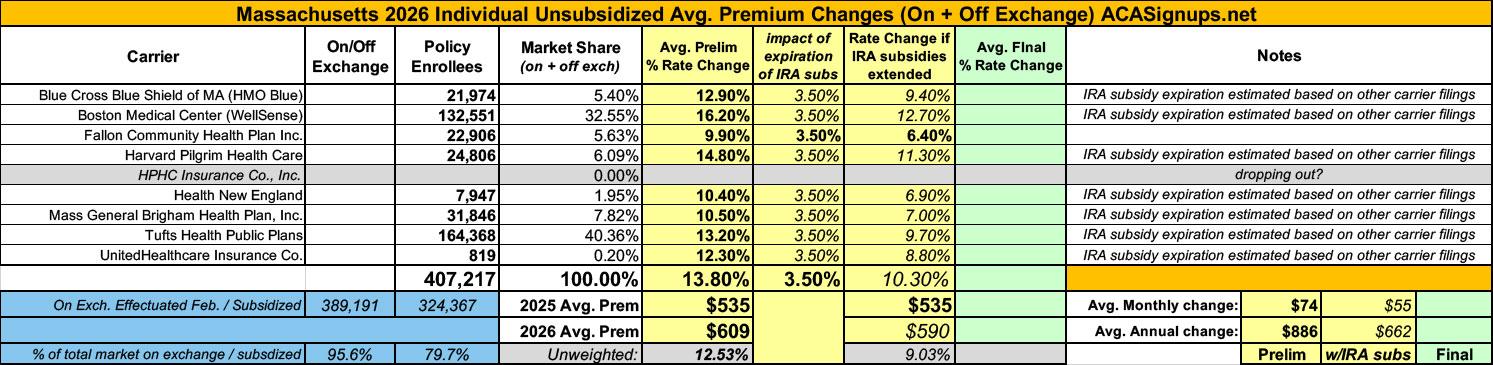

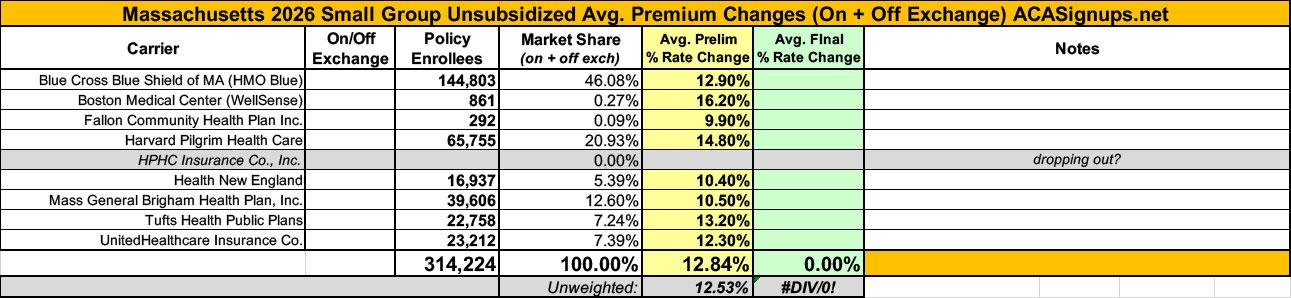

Unlike most states, Massachusetts has a merged individual & small group market risk pool, which means that rate changes to both are based on combined data. The carrier filings still break out how many enrollees each have in their individual vs. small group plans, however, which allows me to run the weighted average rate hikes separately.

Across both combined, there's 721,000 enrollees with a weighted average requested rate hike of 13.4%. If you break it out into the indy & small group markets, however, it's 13.8% for the former vs. 12.8% for the latter.

Unfortunately, only one of the 8 carriers states how much of their rate hike request is specifically due to the IRA subsidies expiring (Fallon Community, which only holds 5.6% of the statewide individual market). However, some of the other carriers do indicate that it plays a "significant" role in the 2026 rate hikes.

Two other significant factors are mentioned repeatedly as well: The massive cost of covering GLP-1 drugs (which it appears many insurers are dropping coverage of after only a couple of years), and the sunsetting of MA's 2-year ConnectorCare expansion program.

Blue Cross Blue Shield of Massachusetts HMO Blue, Inc.

KEY DRIVERS FOR THE PROPOSED RATE CHANGE

- All health plans are required by state and federal law to spend a percentage of the revenue they receive in premiums on the care of their members (versus on administrative costs or for reserves/surplus). In Massachusetts, we have the most rigorous requirements in the nation, whereby at least 88 cents of every premium dollar must be spent on our members’ care. Over the past 10 years, BCBSMA has delivered an average of 88 cents of our merged market premium dollar to our members’ care.

- Costs for medical care and medications for our members have escalated rapidly and spending is now growing at the fastest rate in more than a decade. The surge in spending is putting a heavy burden on our employer customers and members who are struggling to keep up with rising costs. In 2024, five GLP-1 drugs accounted for over $300 million in spend. Drug makers’ prices for these medications have led to an unsustainable increase in the cost of coverage for our members. In response, BCBSMA is affirming its commitment to affordability and discontinuing coverage of GLP-1 medications for weight-loss indications in 2026. This change has an effect of reducing premium rates in 2026 by approximately 3% for our Merged Market members.

- As recent state reports have found, hospital and pharmaceutical costs continue to be the two largest categories of medical spending increases across Massachusetts. More than half of total medical expense trend is driven by increases in provider reimbursements. The effects of inflation and labor shortages have led to large price increase requests from healthcare providers. Additionally, more than 25% of total medical expense trend is driven by pharmaceutical costs. The impact of blockbuster high-cost biologics, and other innovative emerging therapies has a material impact on current trends. These dynamics put added pressure on medical claims, which in turn causes premiums to increase.

- There are several other factors that drive medical spending, including the use of inpatient and outpatient services, an aging population, and the increased cost of prescription medications (especially specialty drugs). In 2024, we experienced significant increases in costs of services like behavioral health, office visits, and outpatient surgeries. The associated additional costs are expected to continue into 2026 and contribute to higher premium rates.

WellSense Health Plan (Boston Medical Center):

KEY DRIVERS FOR THE PROPOSED RATE CHANGE

- Projected higher medical and pharmacy trend:

- We are observing a sustained upward cost trend in medical services. During provider contracting negotiations, the providers tend to demand higher rate increases for our ACA line of business to compensate for the lower Medicaid reimbursement rates on our Medicaid line of business.

- Network re-contracting across all metal tiers, which was necessitated by requirements in the Connector’s 2024 SOA, continues to contribute to the overall increase in provider costs. The discontinuation of the ConnectorCare pilot program would exacerbate the impact as members transition to Bronze plans, where we pay higher provider reimbursement rates.

- The annual trend for behavioral services was near 30% during the past two years, driven by higher utilization from members redetermined from MassHealth and increasing provider cost trends. WellSense expects these trend pressures to continue, even as we insource behavioral health services for 2026.

- Even with the exclusion of anti-obesity GLP-1 coverage, the pharmacy trend remains above double digits. This is largely due to a shift in utilization toward brand-name and specialty drugs, including some newly approved high-cost cell and gene therapies.

- Furthermore, we anticipate higher pent-up utilization driven by the significant membership growth WellSense has experienced since the beginning of 2024. Many of these new members were only partially enrolled during the base period and are expected to elevate their utilization to normal levels in the following years

Risk Adjustment: WellSense has experienced over a 20% average annual increase in risk adjustment transfer payment PMPMs since 2021 and projects this trend to continue in the coming years. Our significant membership growth during the last two years has shifted the demographic profile and lowered our risk scores in the risk adjustment settlement calculation. Having the lowest premium level relative to the merged market average compounds the impact. Also, the federal “CSR Adjustment Factor” to account for benefit richness (or induced demand) does not adequately account for the value of ConnectorCare plans, which offer more coverage than Platinum plans.

Silver Loading: The majority of WellSense members are enrolled in ConnectorCare plans and are expected to receive Federal and State Cost-Sharing Reductions (CSRs) in accordance with ACA regulations. The "Silver Loading" represents the additional premium applied to the Silver A II plan to account for the assumption that no federal CSR funding will be provided. The anticipated discontinuation of the expansion ConnectorCare pilot program will shift the member mix in the Silver A II plan, which will increase our Silver Loading requirement for 2026 rates.

Unanticipated cost pressures for CY 2024 and CY 2025: As we developed rates for 2024 and 2025, WellSense was still experiencing very favorable base claims and a moderate claims trend. For 2024 and 2025, WellSense delivered annual rate increases of -3.3% and 5.7%, respectively, allowing our plans to serve as the most affordable choices in the Massachusetts’ merged market.

However, with significant growth from MassHealth redeterminations and the 2024-25 ConnectorCare expansion pilot, our membership demographic and utilization patterns have shifted substantially. The base experience, emerging trends, and projected risk adjustment payments all indicate an atypical increase in our 2026 base rate is necessary to ensure that WellSense remains financially viable while still providing comparatively affordable options to consumers, especially those receiving federal and state subsidies. From a three-year perspective, WellSense’s average annual increase from 2024 to 2026 remains below 6%, which is lower than the market average. Additionally, most of WellSense’s members are in the ConnectorCare plans, where they will see very limited premium increases due to the cap imposed by the Health Connector’s affordability schedule.

Fallon Community Health Plan:

KEY DRIVERS FOR THE PROPOSED RATE CHANGE

The 9.9% rate change is driven by the following key components:

- 9.8% rate increase due to the risk adjustment transfer

- -3.0% reduction due to base period cost and trend restatement

- 3.5% attributed to claim cost increases due to enhanced subsidy expiration and Connector Care expiration

- -0.4% reduction due to administrative costs

Harvard Pilgrim Health Care:

KEY DRIVERS FOR THE PROPOSED RATE CHANGE

- • Medical Trend: A key driver of health insurance premium increases year-over-year is medical trend, which is comprised of inpatient, outpatient, and physician services. Medical trend includes both increases in the cost of the services provided by hospitals and physician groups and increases in the utilization and severity of these services by our members.

- For 2026, Harvard Pilgrim expects there to be continued upward pressure on medical cost increases, driven by the higher inflationary environment and labor shortages that have led to providers requesting higher rates of reimbursement. While Harvard Pilgrim expects to successfully partner with hospitals and physicians across the state to moderate these cost increases, and continue to make quality care accessible for all, the increases are expected to be above recent historical levels.

- Harvard Pilgrim has also seen a large increase in medical utilization trends, particularly in the second half of 2024, with no signs of moderation in 2025 emerging experience. Utilization has increased across multiple categories of services and is not driven by any single event or service type.

- Pharmacy Trend: Pharmacy spend continues to put significant upward pressure on overall claim trend, particularly for brand drugs such as GLP1s and Immunomodulators, and high cost specialty drugs, and this is expected to continue in 2026. Note that for 2026, Harvard Pilgrim will no longer cover GLP1 for weight loss indications; the reduction in expected future claim costs for this change in coverage is reflected in the filed rates.

Health New England:

Health insurance premiums reflect the cost and usage of medical care and services. Health New England (HNE) has been impacted by increases in these areas due to higher costs and utilization of medical services and prescription drugs. As a result, our medical and pharmacy trends continue to rise.

- The largest driver of HNE’s 2025 requested rate increase is a rise in the costs of medical services and drugs. Pharmacy costs are expected to increase by 10.5% in 2026. This increase is driven by increased use of specialty drugs and the growth of new therapies. Members are also expected to use 3% more prescription drugs in 2026.

- Physicians and hospitals are facing economic pressures caused by supply chain shortages, overall inflation and continued workforce challenges. As a result, providers are seeking higher reimbursement for their services. HNE continues to be diligent but is routinely required to increase service reimbursement rates at levels that exceed the 3.6% cost control benchmark, established by the MA Health Policy Commission, to maintain its current provider network.

Mass General Brigham Health Plan:

KEY DRIVERS FOR THE PROPOSED RATE CHANGE

Mass General Brigham Health Plan was founded by community-based organizations almost 40 years ago. Today, we are continuing to deliver exceptional healthcare experiences in our communities that offer nationwide access to comprehensive coverage with a reputation for excellence. The combination of competitive premiums and a focus on creating consumer-friendly products make Mass General Brigham Health Plan a popular choice for employers and individuals. Our 2026 rate filing reflects investments that expand access to convenient, affordable, and flexible care – from comprehensive mental health services to women’s health supports and virtual care options – while factoring in anticipated uncertainty around the expiration of federal and state subsidies that help to keep care affordable for our members and managing rising healthcare costs. This includes updates to guidelines on the use of GLP-1 medications to provide affordable premiums and a variety of options to support healthy lifestyles. While GLP-1s offer tremendous potential, the pricing by manufacturers is creating significant cost barriers for insurers, employers, and consumers.

The factors that impacted our rate filing include:

- Updates to coverage of GLP-1 medications only for type 2 diabetes for merged market commercial members, with considerations for large employers to add coverage of GLP-1s for weight loss. Investments in strategic initiatives that expand access to high-quality healthcare for our commercial members, including a robust women’s health portfolio, comprehensive mental health solutions, virtual care options, and innovative digital features on fully-insured plans.

- Anticipated impact on membership shifts and medical costs related to the expiration of enhanced federal premium subsidies (associated with the American Rescue Plan Act of 2021 and Inflation Reduction Act of 2022) and the ConnectorCare expansion pilot.

- Industry-wide increases in the cost and utilization of healthcare services reflect regional and nationwide trends.

- Additional costs associated with higher patient acuity due to lasting effects from the deferment of care during the COVID-19 pandemic.

- Accelerated pharmacy trends, including specialty pharmacy services and promising but expensive new-to-market therapies.

- A challenging operating environment for providers due to rising labor costs, capacity challenges and inflation, which are creating upward pressure on commercial reimbursement rates.

- New government requirements for products and rating.

Tufts Health Plan:

- Medical Trend: A key driver of health insurance premium increases year-over-year is medical trend, which is comprised of inpatient, outpatient, and physician services. Medical trend includes both increases in the cost of the services provided by hospitals and physician groups and increases in the utilization of these services by our members. In particular, increased pressure on unit cost trend and inflation drives year-over-year trend increases in medical expense.

- Pharmacy Trend: spend for prescription drugs continues to put significant upward pressure on overall claim trend, particularly for brand drugs such as GLP-1s and Immunomodulators, and high cost specialty drugs, and this is expected to continue in 2026. Note that for 2026, Tufts Health Public Plans will no longer cover GLP-1 drugs for weight loss indications; the reduction in expected future claim costs for this change in coverage is reflected in the filed rates.

- Payer Assessment: The payer assessment has been restructured using a claims-based approach, rather than member count which was anticipated at the time of the 2025 rate filing. As Tufts Health Public Plans has lower average claims than other insurance carriers in the market, we are expecting this change in methodology to result in a decrease to our assessment, which translates to a reduction in the filed rates.

- Expiration of ConnectorCare Pilot Expansion Program: Changes in member eligibility for state subsidies in the Silver 2000 II plan shifts the member mix towards those who are eligible for more federal subsidies. These subsidies are handled via a Silver Load, which is an additional amount of premium included for our Silver 2000 II plan to cover federal cost share subsidies that are no longer funded by the federal government. Changes in the projected member mix for 2026 due to the expiration of the ConnectorCare subsidy expansion result in a higher Silver Premium Load requirement and thus a higher rate increase for 2026.

- Network Changes: Effective January 1, 2025 Point32Health and two provider systems (Boston Children's Hospital and UMass Memorial Healthcare) amicably agreed to terminate our contract for the THPP Direct product. The values in the filing include the impact of those terminations.

UnitedHealthcare:

A rate change increase of 12.3% is necessary for 2026 renewals. This increase is necessary largely due to the following key drivers:

- Medical and pharmacy claim costs continue to increase, including but not limited to the following services which have seen significant increases:

- Outpatient Surgery

- Inpatient Surgery

- Infusion Services and Specialty Drug Costs

- Emergency Care Costs and over-utilization

- Mental Health/Behavioral Health Services, which have seen significant increases in utilization in recent years

- UHIC is required to pay significant payments into the ACA Risk Adjustment program. In 2024, we are projected to pay 5.3% of our premiums into the risk adjustment program.

- UHIC has faced significant increases to administrative expenses, driven by inflationary pressures.