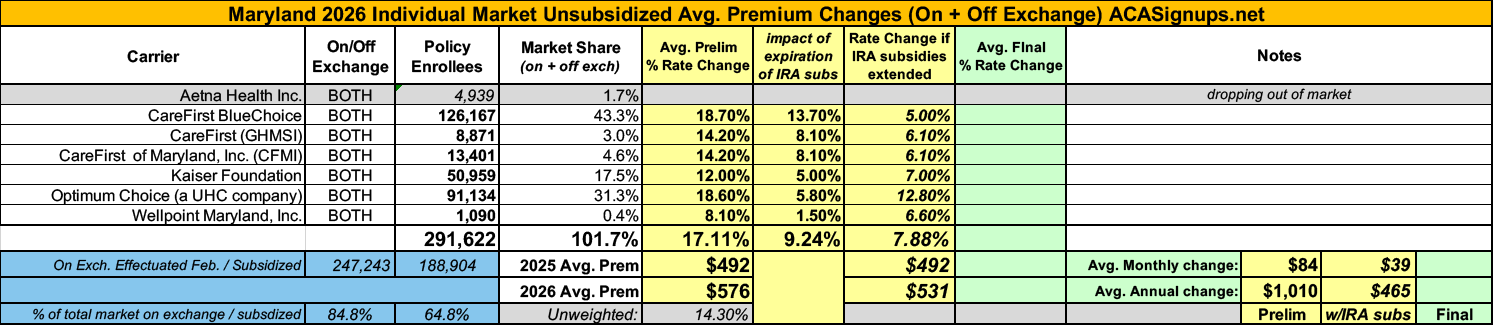

2026 Rate Changes - Maryland: +17.1% avg; 9.2% due specifically to IRA subsidy expiration (preliminary)

This just in via the Maryland Insurance Administration:

Health Carriers Propose Affordable Care Act Premium Rates for 2026

- Anticipated loss of federal enhanced premium tax credits leads to highest individual market rate increases proposed since the start of Maryland’s reinsurance program

BALTIMORE – The Maryland Insurance Administration has received the 2026 proposed premium rates for Affordable Care Act products offered by health and dental carriers in the individual, non-Medigap and small group markets, which impact approximately 502,000 Marylanders.

In the individual, non-Medigap market, carriers are requesting an overall average rate change of 17.1%, with the average request by carrier ranging from 8.1% to 18.7%. Overall, the individual market rate increases filed are the highest since the implementation of Maryland’s reinsurance program in 2019 and reflect the anticipated loss of enhanced federal tax credits that have helped reduce the premiums that Marylanders pay for health coverage in the individual market.

If the enhanced tax credits were to be reauthorized by Congress, filed rate increases would instead reflect an overall average rate change of 7.9%, with most carriers filing for an increase between 5% and 7%.

“The significant rate increases filed with the Maryland Insurance Administration reflect the anticipated loss of enhanced federal tax credits for the 2026 plan year, ” said Maryland Insurance Commissioner Marie Grant. “The Maryland Insurance Administration is closely working with the Maryland Health Benefit Exchange on designing a state subsidy to help mitigate the impact of these losses, as a result of House Bill 1082, which authorizes the Exchange to design a subsidy using special funds available for market stabilization. However, recent actions by Congress have the potential to further lower tax credits for Marylanders to help purchase health coverage and further increase rates in this critical market. We will be examining rates filed by carriers closelyin the coming months, and urge Congress to take action to address affordability of health coverage."

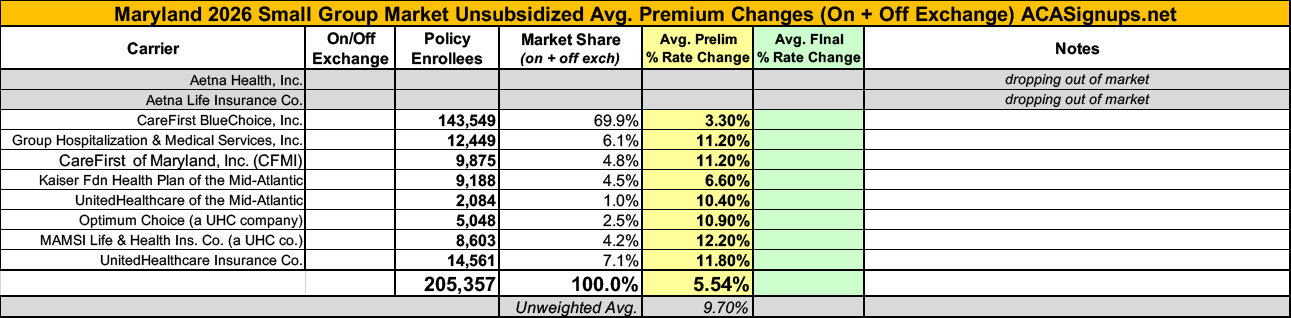

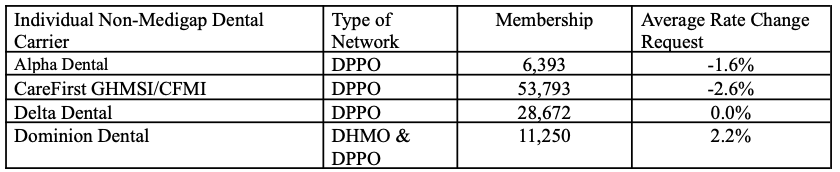

In the small group market, carriers have requested an overall average rate increase of 5.5%, with the averages by carrier ranging from 3.3% to 12.2%. In the individual, non-Medigap, stand-alone dental market, carriers have requested an overall average rate decrease of -1.3% with averages by carrier ranging from –2.6% to 2.2%.

The carriers’ requested increases are reviewed by the Maryland Insurance Administration and rates must be approved by the Commissioner before they can be used. Before approval, all filings undergo a comprehensive review of the carriers’ analyses and assumptions. By law, the Commissioner must disapprove or modify any proposed premium rates that are unfairly discriminatory or appear to be excessive or inadequate in relationship to the benefits offered. The Insurance Administration will hold a public hearing on the ACA proposed rates in July and expects to issue decisions in September 2025.

In the Individual market, Aetna is withdrawing from the market as of December 31, 2025, and any member in an Aetna plan will need to switch to a new carrier for 2026. This is expected to impact approximately 4,939 members. The Insurance Administration encourages anyone affected by this change to work with Maryland Health Connection or a broker to find a new plan.

The Insurance Administration will hold a quasi-legislative virtual public hearing on this matter on July 30, 2025 from 1:30 p.m. to 4:30 p.m. (See public hearing details below.)

“Feedback from all stakeholders is very important and we urge everyone to participate in the public hearing,” Commissioner Grant said. “Health insurance costs impact everyone, and we want to give all Marylanders the opportunity to be heard as we consider the proposed rates.”

SUMMARY OF PROPOSED RATES FOR 2026

For the individual, non-Medigap market, the overall filed average annual rate change across the entire market is an increase of 17.1%. The average filed rate by carrier and the number of impacted members based on enrollment as of April 30, 2025, is:

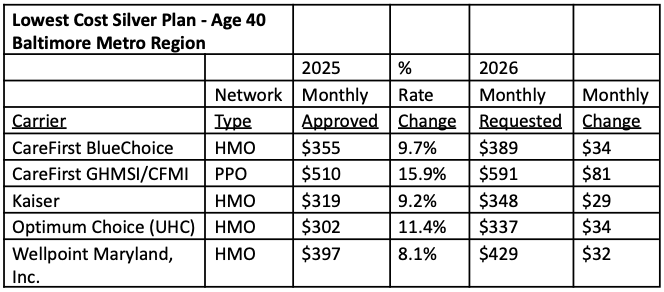

To provide context, and for comparison purposes, the chart below shows the filed 2026 monthly individual premium for a 40-year-old in the metropolitan Baltimore service area purchasing the lowest cost silver plan.

Additional details regarding proposed rate changes in the individual market are provided in Exhibit 1. Additional premium comparisons for bronze and gold and for an illustrative Family of 4 are found in Exhibit 2.

Note that all illustrative premiums are the full unsubsidized premiums prior to the application of any Advance Premium Tax Credits (APTCs) from the federal government or the state young adult subsidy pilot. Almost 80% of applicants who purchase a plan on marylandhealthconnection.gov receive APTCs and will not pay the full premiums shown here. APTCs vary by a household’s income and are linked to the unsubsidized cost of the second lowest cost silver plan available to a household.

For the small group (50 or less full-time equivalent employees) market, the overall filed average annual rate change is an increase of 5.5%. In the small group market, a health carrier can request rate changes on a quarterly basis. The proposed average rate changes by carrier for all four quarters of 2026 and the number of impacted members based on enrollment as of March 31, 2025 is:

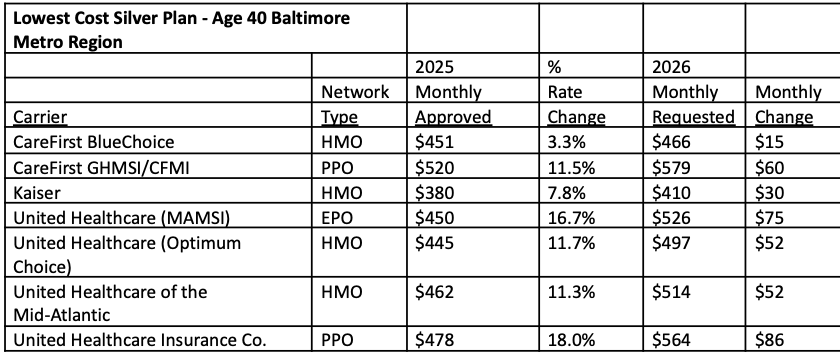

To provide context, and for comparison purposes, the chart below shows the filed monthly premium for a 40-year-old subscriber for the first quarter of 2026 in the metropolitan Baltimore service area in the lowest cost small group silver plan. These monthly premium amounts may be shared between the individual and the employer, as employers often contribute to the cost of employee insurance.

Additional details regarding these proposed rate changes are provided in Exhibit 3. Additional premium comparisons for bronze and gold and for an illustrative Family of 4 are found in Exhibit 4.

For the stand-alone dental market, four carriers submitted premiums. The average filed rate by carrier and the number of impacted members based on enrollment as of April 30, 2025 is:

Additional details regarding these proposed rate changes are provided in Exhibit 5. Illustrative premiums for both Self-Only and Family coverage can be found in Exhibit 6.

Rates being reviewed by the Insurance Administration do not affect health insurance plans offered by large employers or by employers who self-insure; “grandfathered” plans purchased before March 2010; or federal plans such as Medicare (including Medicare Advantage or Medicare Supplement), Tricare and federal employee plans.

The six exhibits listed below provide more detail.

- EXHIBIT 1: 2023 ACA, Individual Non-Medigap Market – Rate Filing Summary

- EXHIBIT 2: Illustrative Individual Non-Medigap 2025 Premiums

- EXHIBIT 3: 2025 ACA, Small Group Market – Rate Filing Summary

- EXHIBIT 4: Illustrative Small Group 2025 Premiums

- EXHIBIT 5: 2025 ACA, Individual Non-Medigap, Stand-Alone Dental Market – Rate Filing Summary

- EXHIBIT 6: Illustrative Individual Stand-Alone Dental 2025 Premiums

Rate filing documents are available on the Insurance Administration’s website at www.healthrates.mdinsurance.state.md.us, which also includes answers to frequently asked questions about the rate review process. All interested persons may review filings and submit comments through Aug. 30, 2025.

In addition, any interested person may participate in the virtual public hearing scheduled for Tuesday, July 30, 2025 from 1:30 p.m. to 4:30 p.m. Time limits may be imposed for oral testimony, depending on the number of participants. If you would like to present or offer public comments during the public hearing, please notify the Insurance Administration in advance by submitting your request to healthinsuranceratereview.mia@maryland.gov. To the extent that time and technology permit, the Insurance Administration will hear from unregistered participants who access the Zoom Webinar platform.

Public Hearing Log-In Information:

- When: July 30, 2025, 1:30 p.m. to 4:30 p.m.

- ZoomGov Link

- Dial-In: (646) 828-7666

- Webinar ID: 161 556 5010

Written testimony for the public hearing may be submitted by email to healthinsuranceratereview.mia@maryland.gov and must be received by 5 p.m. on Friday, July 27, 2025 to be addressed at the hearing.

Questions about Maryland’s rate review process should be directed to Brad Boban, Chief Actuary at 410-468-2041, or by email at bradley.boban@maryland.gov.