Pennsylvania: ~18% of 2025 enrollees forced to drop coverage already due to GOP failing to extend tax credits

via Pennie, Pennsylvania's state-based ACA exchange:

One in Five Pennie Enrollees Drop Health Coverage Due to Expired Federal Tax Credits

High demand seen for quality affordable coverage during Open Enrollment Period.

Harrisburg, PA – Pennie, Pennsylvania’s official health insurance marketplace, concluded its 2026 Open Enrollment Period with enrollment totaling around 486,000 and with adverse effects from unprecedented cost increases. A doubling of premium costs caused around 85,000 Pennsylvanians to drop coverage, meaning that nearly 1 in 5 enrollees were unable to keep their health plan for 2026.

Technically speaking that's 17.5% of existing enrollees, not 1 in 5, but it's still a lot of enrollees dropping coverage right out of the gate. For comparison, last year, only 5.7% of Pennsylvania enrollees as of December 2024 dropped coverage as of the end of the official 2025 Open Enrollment Period. (The national average was 5.6% last year).

In other words, PA enrollees have already dropped coverage at more than 3x the rate they did a year earlier.

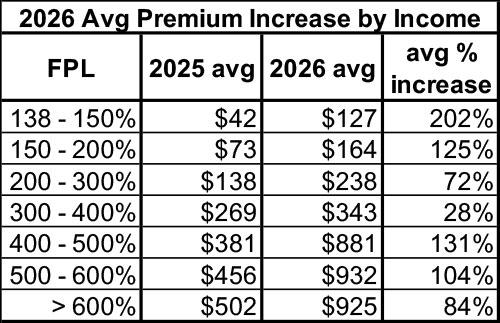

The cost increases were a result of the expiration of enhanced premium tax credits that Congress did not extend. Without these additional tax credits, Pennie enrollees were faced with an average price increase of 102% to remain in their plan for 2026, creating significant affordability challenges for many Pennsylvanians.

At the start of this Open Enrollment before the cost increases took effect, Pennie was pacing ahead in enrollment numbers compared to last year. Once Open Enrollment began and the reality of the higher premium increases set in, Pennie saw steady and high volumes of disenrollments.

Over the course of Open Enrollment:

- Total enrollment lost pace with prior years. 2026 enrollment went from being 11% higher at the start of Open Enrollment to being 2% lower by the end, when compared to 2025.

- Continued demand seen for high quality coverage. Roughly 79,500 Pennsylvanians enrolled in coverage through Pennie for the first time, but it was clear that costs remained a barrier with new enrollment being 12% lower than last year.

- Significant loss of coverage. Nearly 18% of enrollees dropped coverage altogether. Terminations were highest among older and rural Pennsylvanians, and those with incomes just above Medicaid or above the new income cliff. Fifteen of the top twenty counties, based on proportional disenrollment, were rural counties. Access to healthcare is already limited in rural counties, many in these areas relied on enhanced premium tax credits to afford the higher premiums often seen in less populated areas.

- Shift to lower levels of coverage. Around 33,000 more Pennsylvanians enrolled in bronze plans this year compared to last year – a 30% increase. These plans have lower monthly premiums but often have thousands of dollars more in out-of-pocket costs when medical care is needed.

Pennie was uniquely positioned to help Pennsylvanians navigate these rising costs and find coverage that fit their health and financial needs. Pennie was the first state marketplace in the nation to proactively notify enrollees about the upcoming premium increases for 2026 coverage and used a multi-channel approach to communicate the changes. By the start of Open Enrollment, many enrollees understood the reason for higher costs and were informed about their coverage options and next steps. Pennie extended Open Enrollment deadlines, giving consumers more time to shop, compare, and select the best plans for their budgets.

The story is far from over regarding impacts of the cost increases. During Open Enrollment, new enrollments temporarily offset the surge in terminations. Now that Open Enrollment is closed, new enrollments will be limited while terminations are expected to continue at elevated levels for several months. Enrollees receiving tax credits have three months to pay outstanding premiums before coverage is ended; Pennie will not have a complete picture of the premium increase impact until this spring.

Pennie has heard from many Pennsylvanians facing the difficult decision to go without health coverage. Many have reported that the decision to keep or drop coverage is not a matter of choosing a different plan, but of choosing between health coverage and other necessities like rent, food, and utilities. Others have raised concerns about being able to care for medical issues and to stay healthy enough to keep working if they must go uninsured. Those facing health insurance premiums that would consume nearly 50% of their income voiced shock and dismay at the impossibility of staying covered.

Overall, the Open Enrollment period resulted in higher numbers of uninsured and underinsured Pennsylvanians. Financially, rising uninsured rates create significant strain on Pennsylvania’s healthcare system and economy. Higher uninsured populations drive up medical bankruptcy and debt, discourage entrepreneurship and small business employment, and increase uncompensated care costs for hospitals and providers. These financial pressures weaken the healthcare system as a whole, especially for many rural hospitals that are already operating on thin margins where even small increases in the uninsured rate can threaten their long-term viability. On the health side, more uninsured residents mean delayed care, worse health outcomes, and a greater reliance on emergency rooms. When conditions go untreated, Pennsylvanians are more likely to experience preventable complications, permanent disabilities, and a reduced ability to work and live independently.

As Pennie continues to monitor enrollment and terminations in the months ahead, the full impact of rising premiums will become clear – not just in enrollment numbers, but in the health and stability of communities across Pennsylvania.

To learn more and see regional impacts, visit pennie.com/affordability.

Even though Open Enrollment is over, Pennsylvanians may still enroll if they lose other coverage or have a major life event, such as moving or having a baby. Pennsylvanians needing coverage can visit pennie.com or call 844-844-8040 to explore affordable options on quality coverage and their eligibility for financial savings. Four of five enrollees qualify for premium tax credits.

Here's more details from the Pennie Affordability page:

- Total OEP Plan Selections: 486,577 (down 2.0% y/y from 496,661 in 2025)

- Total New Plan Selections: 79,462 (down 12% y/y from 90,472 in 2025)

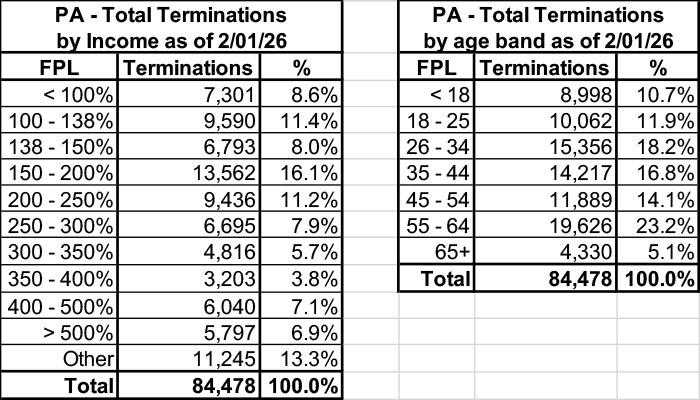

Total Terminations by income as of 2/01/26:

- The highest level of terminations by income have been in the 150-200% Federal Poverty Level (FPL) range, $23,475 to $31,300 for a single adult.

- For a family of four, two adults with two children, in the same FPL range, the income would be between $48,225 and $64,300.

-

Individuals and households ages 55-64 are terminating coverage at the highest levels among all age groups.

-

Younger, healthier individuals ages 26-34 are terminating coverage at the second highest levels among all age groups, which adversely impacts risk pools and drives premiums higher.

Unfortunately, Pennie doesn't provide details on their metal level plan shift, but they do give a hint: The press release states that Bronze plans went up 30% year over year, with 33,000 more enrollees selecting them.

In 2025, the breakout was:

- Catastrophic: 1,128 (0.2%)

- Bronze: 113,793 (22.9%)

- Silver: 164,736 (33.2%)

- Gold: 216,496 (43.6%)

- Platinum: 508 (0.1%)

- Total: 496,661

If Bronze plans went up 33,000 enrollees, that puts Bronze at around 147,000 out of 486,577 this year, or 30.2% of the total, up from 22.9%.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.