Premium Alignment, or how a dozen states are quietly providing ACA enrollees w/better options even in the face of expiring tax credits

I've written multiple times in the past about "Silver Loading," the ACA health insurance policy pricing strategy in which insurance carriers load the extra cost of their Cost Sharing Reduction financial burden (the portion of deductibles, co-pays & coinsurance which they're required to cover themselves for low-income enrollees who select Silver plans) onto the gross premium of those same Silver plans.

It gets a bit wonky, but the bottom line is that Silver Loading results in the gross price of Silver ACA plans increasing significantly even if the price of Bronze, Gold & Platinum plans only go up modestly. This may sound bad, but stay with me.

From the carriers perspective, how the CSR load is allocated doesn't matter much as long as they aren't left stuck with the bill...but pricing the plans in this fashion has major implications for the enrollees themselves.

This is because the formula for the ACA's advance premium tax credit subsides (APTC) is based on the gross price of Silver plans: If the price of Silver plans increases, so do the subsidies for those eligible..but you can use APTC to enroll in non-Silver plans if you wish.

This in turn means that if Silver plans go up by, say, 30% while Bronze & Gold only go up by 10%, the net premium you pay for a Bronze or Gold plan will be significantly lower.

Even before the enhanced tax credits went into effect five years ago, there were some parts of the country where some enrollees could get Bronze plans for free, while Gold plans (which have lower deductibles/etc than non-CSR Silver plans) could cost the same or even less than Silver, as backwards sounding as this may seem. There are even some people who qualified for $0-premium Gold plans.

It's important to note that Silver Loading is only relevant (or should only be relevant) for enrollees who earn more than 200% of the Federal Poverty Level (FPL), since those who earn less than 200% FPL should usually* stick with Silver plans to take advantage of the more generous high CSR assistance itself.

Again, CSR turns Silver plans into "Secret Platinum" plans by boosting their Actuarial Value (AV) from around ~70% (standard Silver) to either ~94% (for enrollees who earn up to 150% FPL) or 87% (enrollees who earn 150 - 200% FPL). In simple English, high CSR plans have dramatically lower deductibles, co-pays & coinsurance than Bronze, standard Silver or even Gold plans.

For enrollees over 200% FPL**, the enhanced tax credits have dramatically strengthened the impact of Silver Loading, of course, allowing far more people to become eligible for more comprehensive & affordable ACA plans across the board. Those earning 200 - 400% FPL have been able to leverage Silver Loading even more to their advantage, while those earning over 400% FPL--who previously weren't eligible for any financial assistance whatsoever--were able to utilize both the expanded subsidies and Silver Loading to get a better value.

The subsidy formula reverting back to pre-2021 levels (actually even worse than that, but that's another discussion) is still devastating to millions, of course, but it would be far worse for millions of over-200% FPL enrollees if Silver Loading wasn't an option...even if most of them don't realize they're benefiting from it.

However, Silver Loading is actually effectively a subset of another ACA pricing policy called Premium Alignment.

Premium Alignment (PA) gets even wonkier; I'm not going to explain it here again, but the bottom line is that PA maximizes APTC subsidies even further, resulting in even more dramatic improvements in value and affordability for millions of ACA enrollees.

As a bonus, states which implement PA are actually complying with the spirit of the legislative text of the ACA itself more closely than states which aren't doing so. As a further bonus, PA is actually completely non-partisan: States which have implemented it include blue states like New Mexico and Maryland...but also red states like Wyoming and Texas.

For 2026, there are three more states which are newly-implementing robust PA policies...and again, these include two blue states (Washington and Illinois) and one deep red one (Arkansas; you may recall I recently wrote a deep dive into their move to PA pricing decision).

So far, however, this is all a bunch of confusing wonk speak. What does it mean in real-world terms? Let's dig in!

First, KFF has a wonderful tool which lets you compare the unsubsidized prices of the average lowest-cost Bronze, Silver or Gold plans against the average Benchmark Silver plan in every state, dating back to 2018.

For instance, in my home state of Michigan, the average benchmark Silver plan costs $404/mo this year, while the lowest-cost Gold plan averages slightly higher at $415/mo. For 2026, these are both going up significantly: The benchmark will be $523 while the lowest Gold will be $561. Since Michigan is not, unfortunately, among the states which has implemented PA, this makes sense.

By contrast, take a look at New Mexico, which implemented PA several years ago: In 2025, the lowest Gold averages over $100 less than the benchmark Silver ($407 vs. $515); next year this will still be the case ($509 for lowest Gold vs. $623 for benchmark Silver).

For both years, you can get a Gold plan for around 80% of the cost of Silver...and remember, that's before any APTC subsidies are applied. Adding the tax credits makes the contrast even starker (knocking both down by $100/mo, for instance, means the Gold now costs just 74 - 78% as much as Silver).

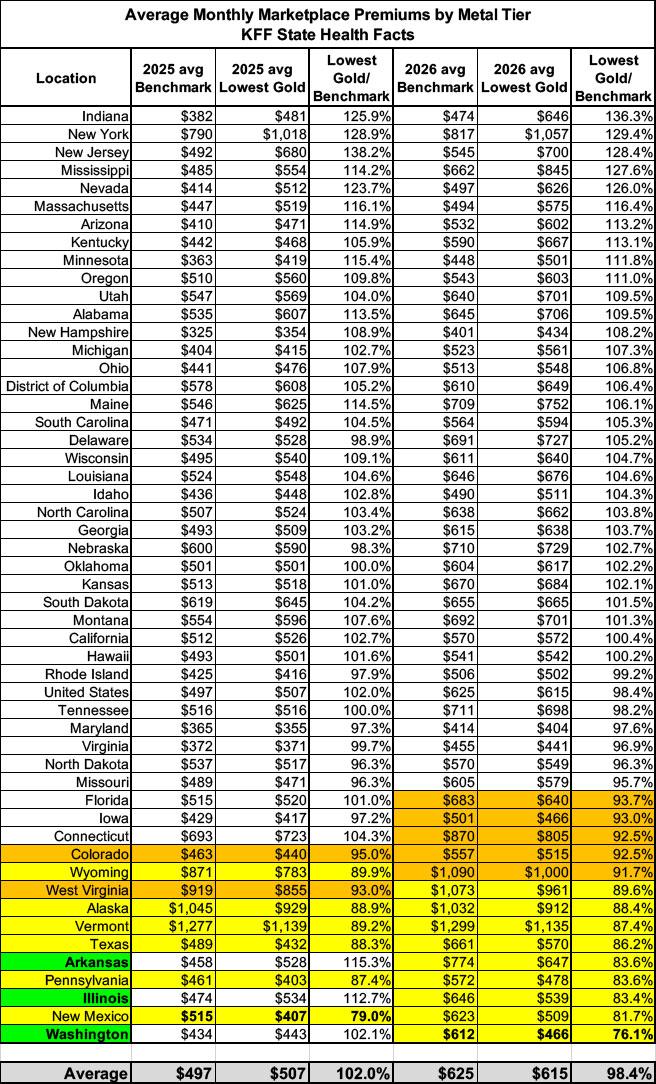

When I download the data from KFF, here's what it looks like for every state (again, at full price):

I've sorted the states from highest to lowest ratio of Lowest Gold (LG) to Benchmark Silver (BS) as of 2026. The states in yellow are where the ratio is less than 90%; states in orange are between 90 - 95%, what I guess you'd call "weak PA" states, where it's been implemented but not strongly.

It's also possible that some of these are only that low due to oddball pricing quirks, as I haven't heard anything about either Iowa or Connecticut going the PA route, although I did hear a rumor that Florida was quietly doing so this year.

As you can see, Washington, Illinois and Arkansas (bold, in green) show a huge change year over year: All three went from Gold costing more than Silver to Gold dropping well below the benchmark plan, ranging from 16 - 24% lower.

States which already had PA policies in place like New Mexico, Pennsylvania and Texas are here as well (although NM's PA actually looks a bit weaker next year), along with several other states.

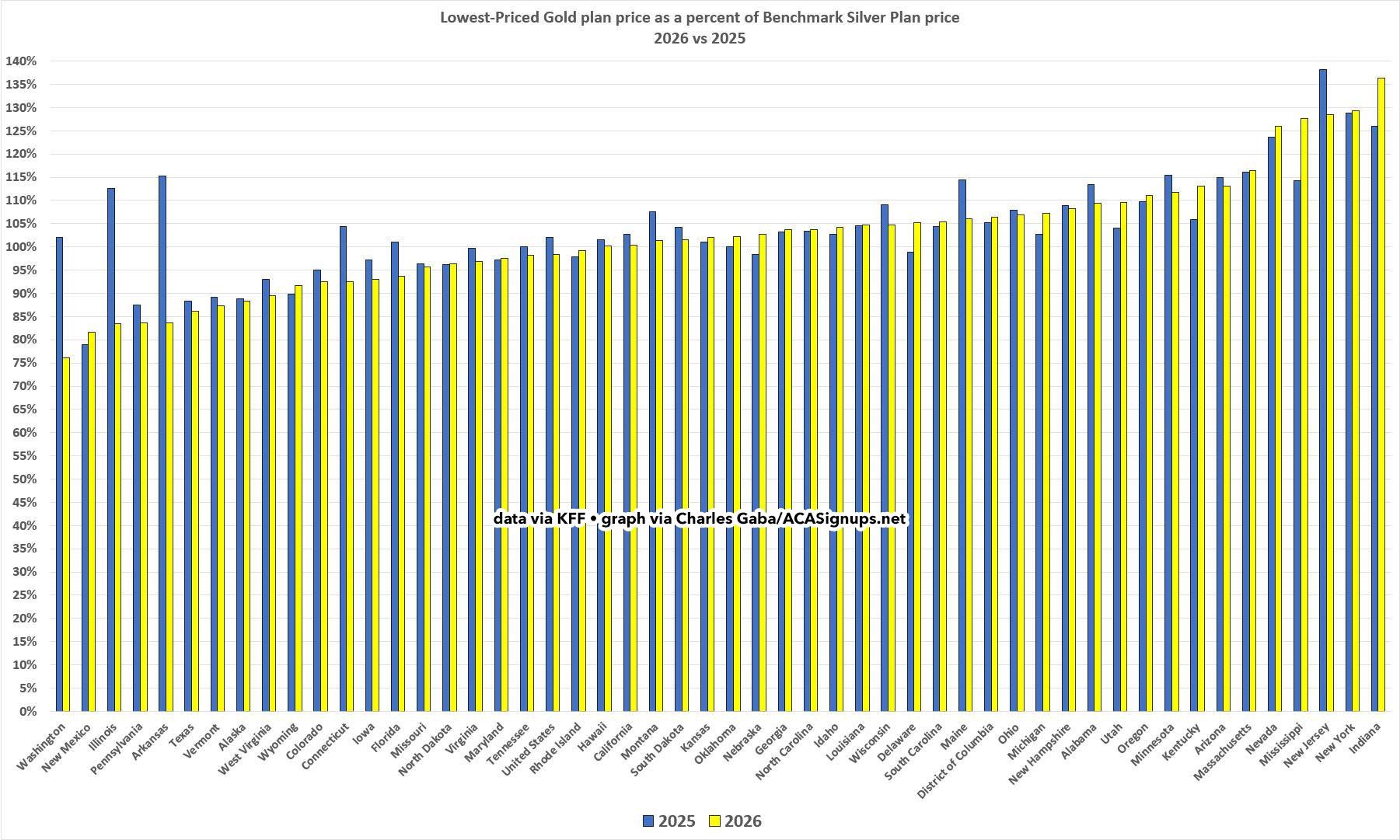

Here's what this looks like visually...you can see how dramatic the year over year drop is in AR, IL and WA. You can also see a few other states with less impressive drops (which, again, could be unrelated)...and, unfortunately, some where the ratio actually increased (including, I'm afraid, Michigan).

At the opposite end of the spectrum is Indiana, where the lowest-priced Gold plan will cost over 36% more than the benchmark Silver plan at full price. In fact, the gap between the Gold and Silver plans for Hoosiers will actually increase by over 10 points next year. Other poor ratios include New York, New Jersey (although theirs drops somewhat next year) and Mississippi, which will have the gap grow even more than Indiana by an additional 13 points.

What does this mean in terms of how much actual enrollees have to pay for Gold or Bronze vs. Silver plans?

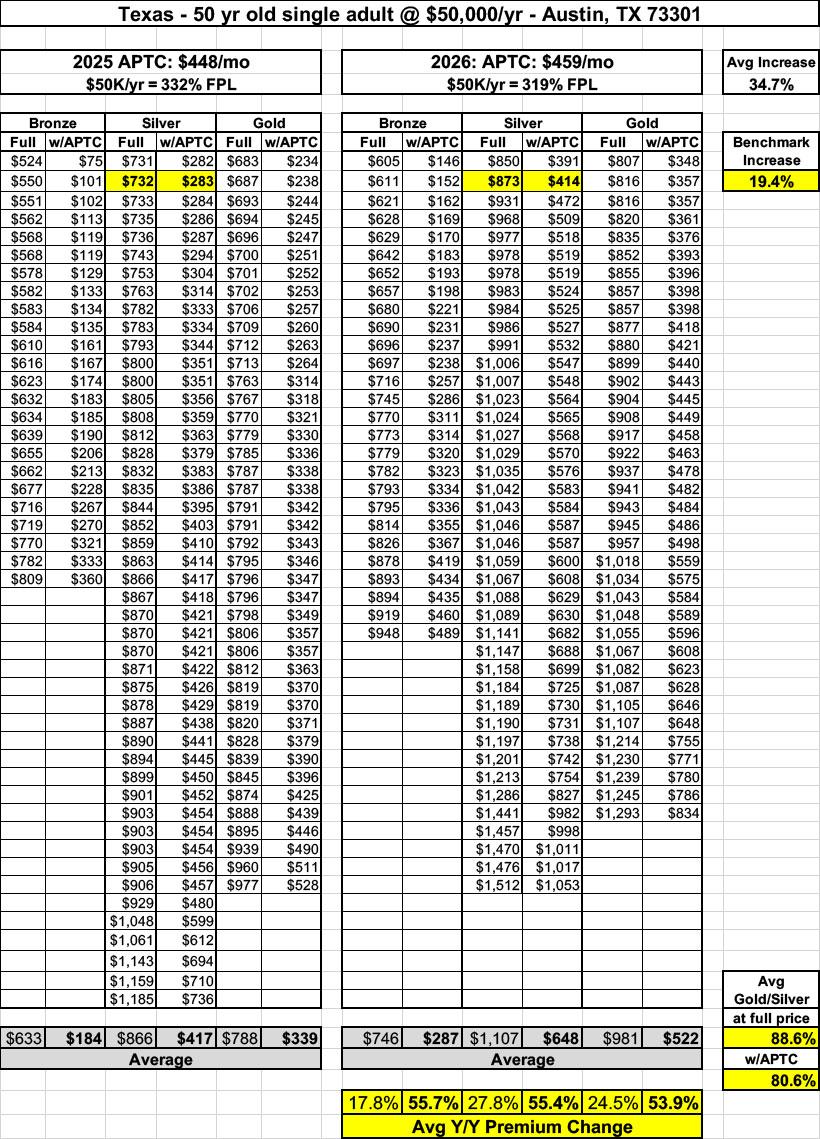

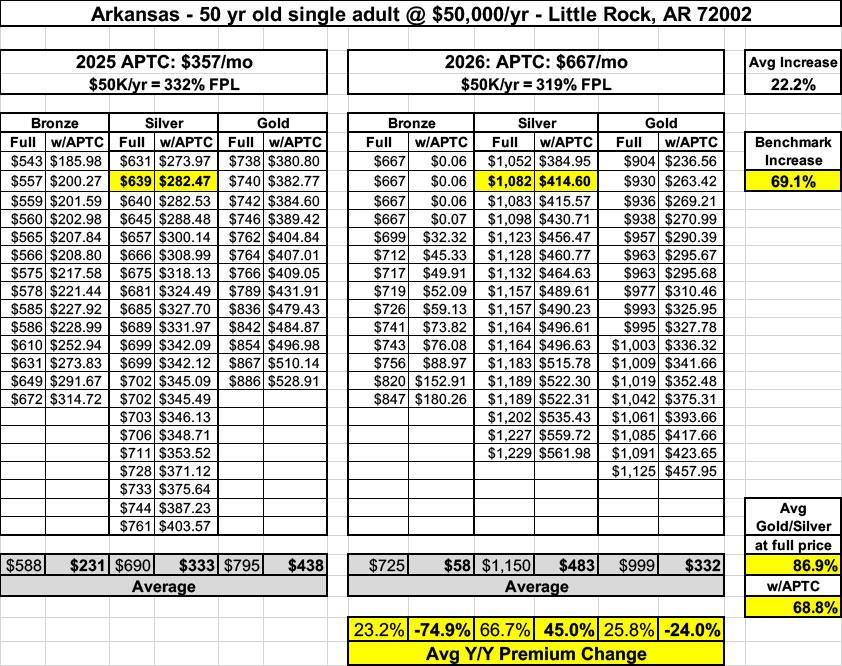

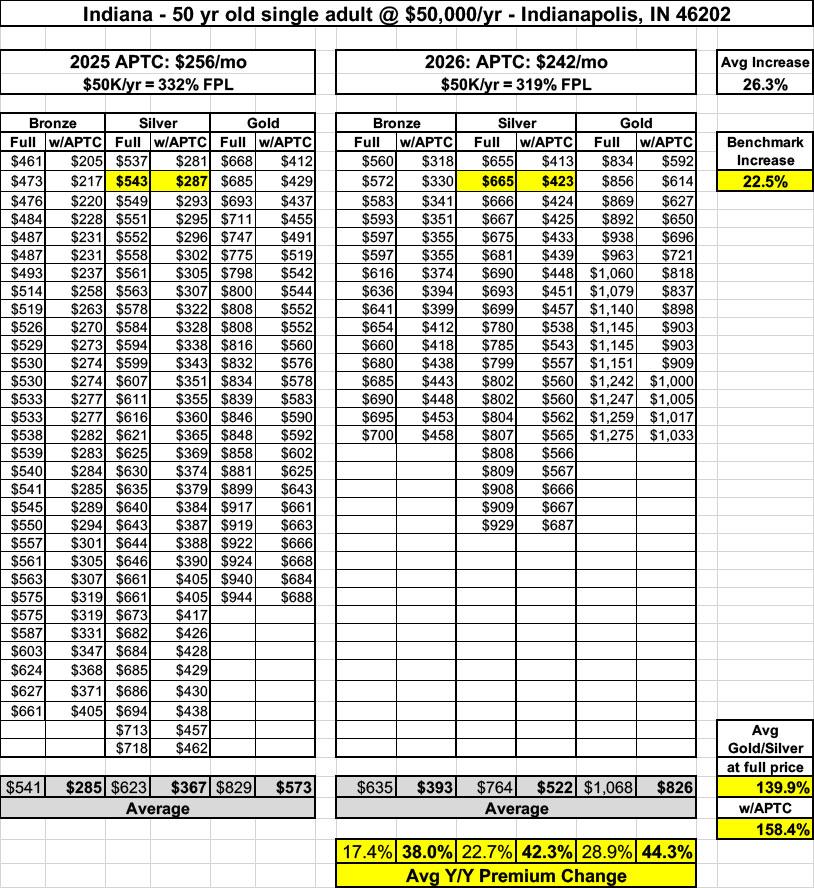

First, the ground rules: Since those who earn less than 200% FPL are usually better off with Silver plans and those who earn over 400% FPL aren't going to be eligible for APTC subsidies at all starting in January, for all examples I'm using a 50-yr old single adult who earns $50,000/year, which is 332% FPL in 2025 and 319% FPL in 2026.

I'm going to apply this to the one of the states newly-implementing PA policies (Arkansas); one state which have been doing so for a few years now (Texas); one state which isn't utilizing PA which is in the middle of the pack (Michigan) and one which seems to be dead set on going completely the wrong direction (Indiana).

Note that I'm assuming the 50-yr old lives in the capital city of each state.

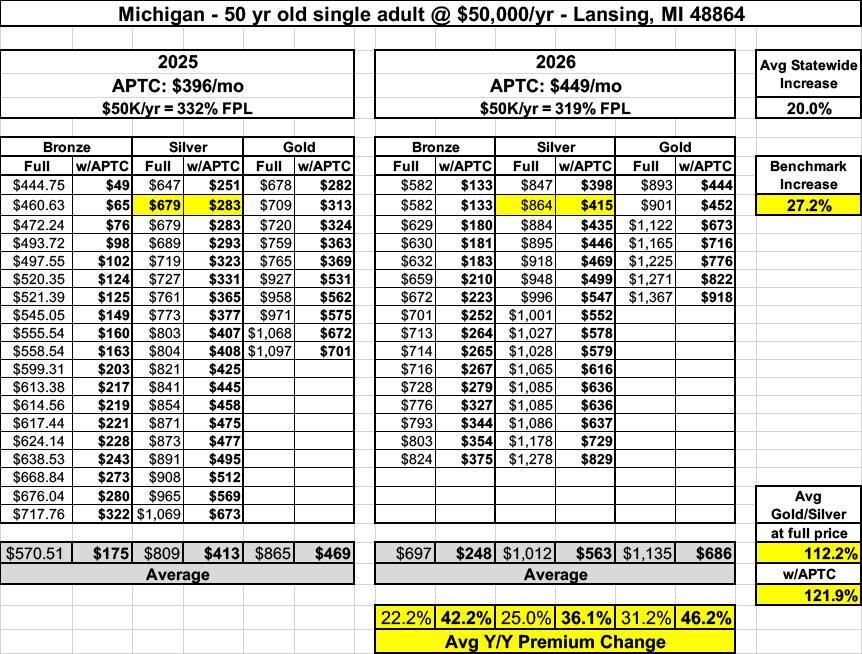

First, let's look at my home state:

In Lansing, Michigan, a 50-yr old earning $50K/year is eligible for $396/mo in APTC this year, making Bronze plans range from $49 - $322/mo, Silver from $251 - $672 and Gold from $282 - $701.

In 2026, the 27% increase in the price of the benchmark plan means that he's eligible for slightly more APTC assistance ($449/mo) even though the formula has been substantially weakened; under the current formula he'd be eligible for $580/month. As a result, he'd have to pay 46% more for the benchmark plan ($415 vs. $283) next year.

In Lansing, at full price, Bronze plans are up 22% on average, Silver is up 25% and Gold is up 31%, meaning there's no premium cost reason for anyone subsidized on Silver to move to Gold, since their APTC would lose value in the process: The average Gold plan costs 12% more at full price and 22% more after subsidies are applied.

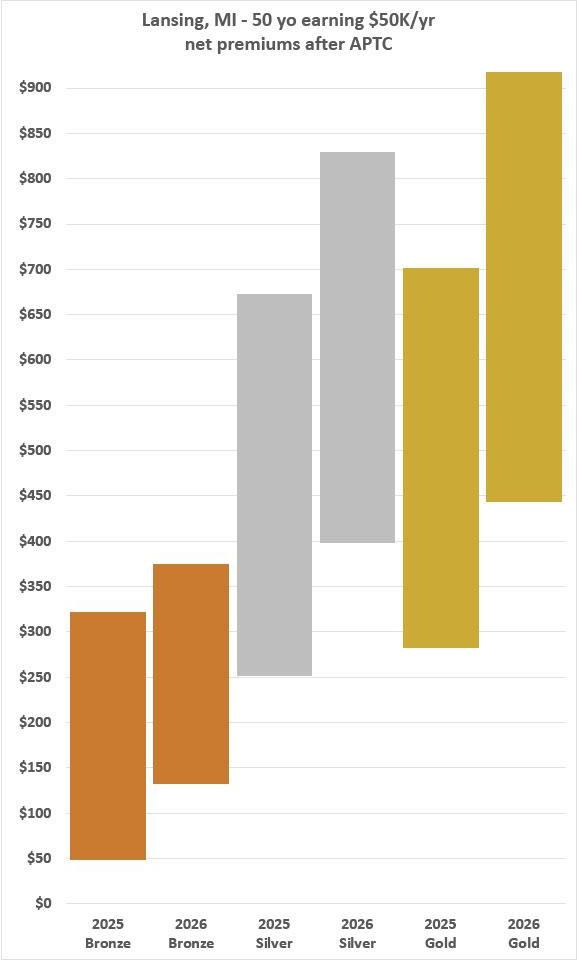

Here's what it looks like visually: The Bronze, Silver and Gold plans have all gone up in price even after subsidies are applied. Ugh.

By contrast, let's look at Texas, the largest and perhaps most unlikely state to legislatively pass robust Premium Alignment to date:

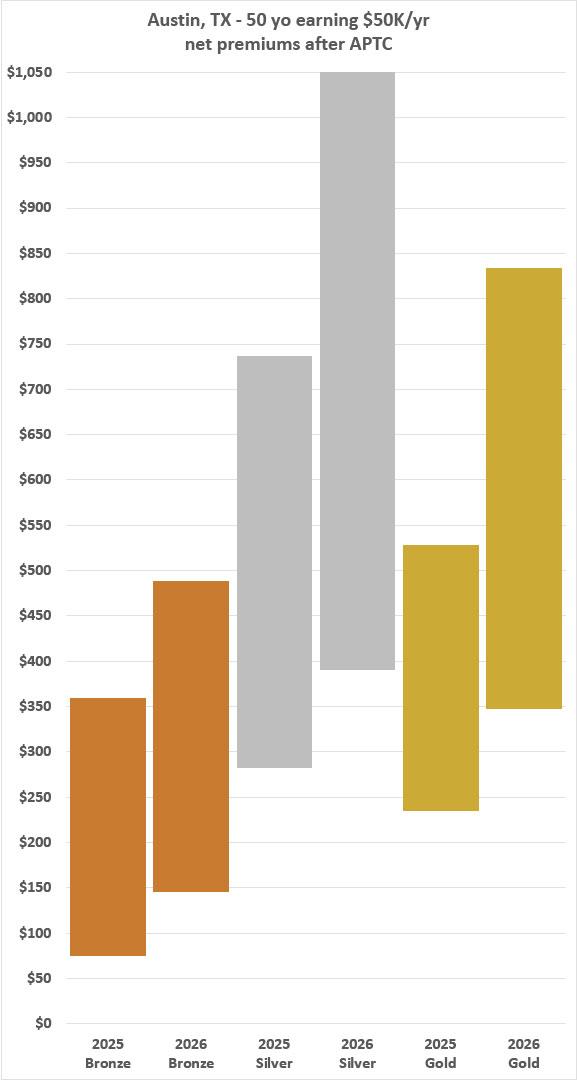

Texas has had Premium Alignment in place for several years now, so most of the pricing advantage there has already been baked in. As a result, net premiums still went up for all three metal levels when compared year over year...but notice how unlike Michigan, in Texas Gold plan pricing averages considerably lower than Silver plans: Over 11% lower at full price and nearly 20% lower when APTC assistance is applied.

In this case the increase in net pricing from 2025 to 2026 is pretty much entirely due to the expiring tax credits: If 2026 pricing was identical but the enhanced APTC formula was still in place, the enrollee would be eligible for an additional $131/mo in APTC, which would save him an additional $1,572 for the year. This would have knocked the Gold plans down to as low as $217/month. Unfortunately, they'll have to settle for paying as little as $348/mo, which is still $43 less than the least-expensive Silver plan.

Next, let's take a look at one of the three states which is newly implementing Premium Alignment...Arkansas, which I spent so much time writing about a month or so ago:

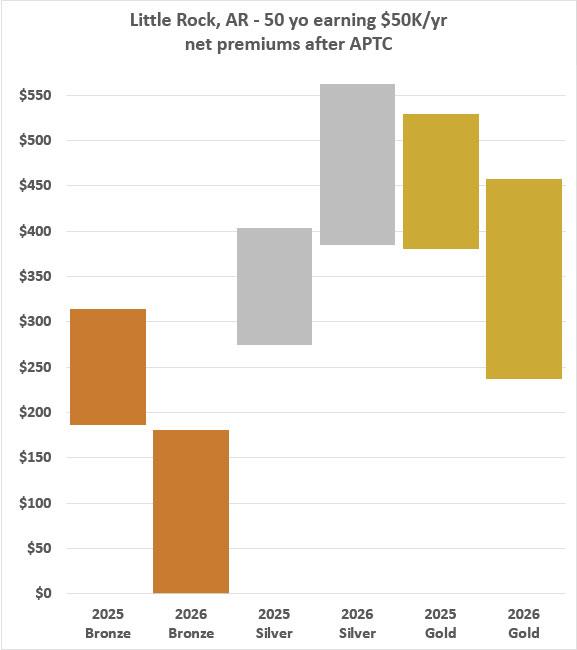

Little Rock has a lot fewer total plans to choose from than Austin, and they also cover a much narrower price range both years. The key numbers to pay attention to are the benchmark plan's whopping 69% gross increase and the 67% average gross hike for Silver plans overall...compared to the much smaller increases in Bronze and Gold plans.

Net result? The average Gold plan costs 13% less than the average Silver plan at full price...and a stunning 31% less after APTC is applied!

This is entirely thanks to Arkansas enacting an extremely aggressive Premium Alignment policy. Here's what it looks like visually...you can clearly see how both Bronze and Gold plan prices have plummeted after APTC is applied, even as Silver plans spike sharply:

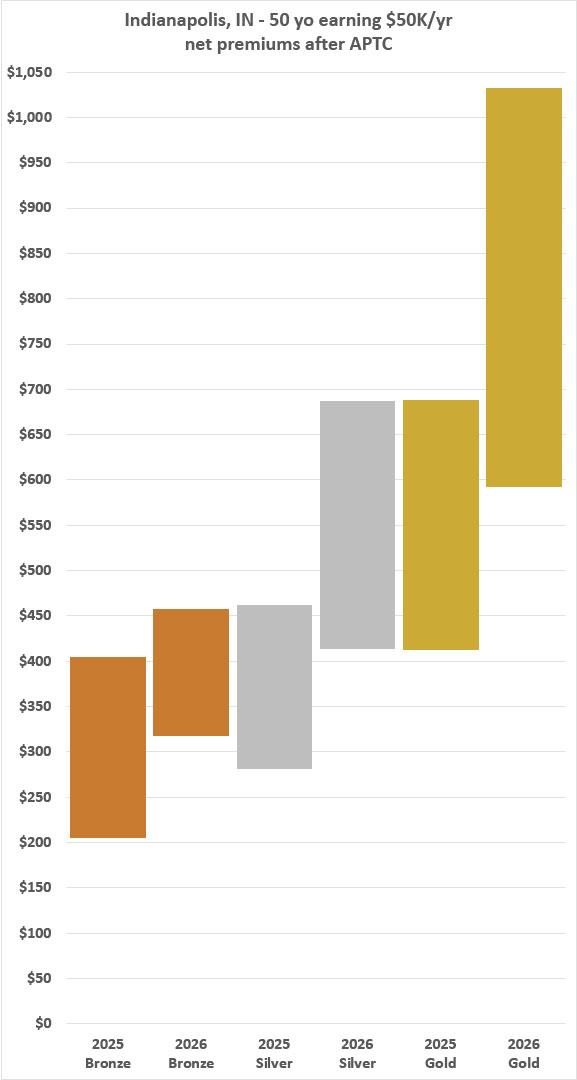

Finally, here's a counterexample: A state which not only hasn't embraced Premium Alignment, but which seems to have gone out of their way to avoid any sort of pricing policy which might even incidentally benefit enrollees: Indiana.

OUCH. In this case, the enrollee is actually receiving slightly lower APTC assistance ($242/mo vs. $256/mo) at the same time that average Bronze plans have shot up 38%, Silver plans 42% and Gold plans 44% even after the tax credits are applied.

On average, Gold plans will cost 40% more than Silver at full price and an even uglier 58% more after APTC is applied:

BOTTOM LINE: SILVER LOADING IS GOOD. PREMIUM ALIGNMENT IS EVEN BETTER. If you live in a state where the last column in the first graph above is over around 90%, contact your state legislator, governor and/or insurance commissioner and urge them to implement robust Premium Alignment for 2027 to help at least partially mitigate the damage caused by the expiring tax credits (and if they are extended after all, robust PA will help people even more!)

TO BE CLEAR: Premium Alignment is NOT a substitute or replacement for making the enhanced ACA tax credits permanent. It does little to help most folks earning less than 200% FPL or over 400% FPL if they're allowed to expire...and even for those between 200 - 400% FPL (roughly 6 million enrollees at the moment) it's a complement to the upgraded subsidies, not a replacement for them. In states where it was already implemented before 2026, the lost tax credits will still cause net expenses to go up (as you can see in Texas).

HOWEVER, it's still hugely helpful to those who know how to take advantage of it, and particularly in the three states newly implementing it (Arkansas, Illinois and Washington State), it should relieve a huge portion of the pain being caused by the enhanced APTC expiring next month.

*Note: As David Anderson reminds me, this isn't a universal truth; there are some cases where someone below 200% FPL might be better off with a dirt-cheap Bronze or Gold plan.

**CSR assistance is also available to enrollees who earn 200 - 250% FPL, but it's far weaker at this level (73% AV) than under 200% FPL, so it's more of a judgement call as to whether a CSR Silver or a Silver Loaded Gold plan is a better option.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.