CBO makes it official: 16 million Americans would become uninsured under the #MAGAMurderBill (when combined w/IRA subsidy expiration)

The Congressional Budget Office has published several projections about how many people would lose healthcare coverage and/or become uninsured (these aren't the same thing) under various versions of the #OneBigUglyBill Act passed by House Republicans, which is currently beginning its next phase over on the Senate side of the Capitol.

Their most recent projection put the total at around 11.7 million when you include some technical weirdness which I'm a little vague about...plus another 3.8 million if you include their projection from December 2024 regarding the impact of the upgraded ACA subsidies included in the Inflation Reduction Act being allowed to expire at the end of this year. This placed the grand total at around 15.5 million...except they more recently sent a letter to the House Energy & Commerce Committee which bumped this estimate up a bit more, putting the combined total at 15.9 million.

This morning the CBO published a completely updated projection based on the actual version of the #OneBigUglyBIll which House Republicans passed...and also sent a separate letter to the Ranking Members of the Senate Finance Committee, House Energy & Commerce Committee and House Ways & Means Committee which brings it all together and details every part of their rationale:

Dear Ranking Member Wyden, Ranking Member Pallone, and Ranking Member Neal:

You have asked the Congressional Budget Office to analyze how federal policy would change the number of people without health insurance.

Specifically, you asked for changes resulting from:

- Two policies incorporated into CBO’s baseline budget projections under current law, and

- Several policies included in H.R. 1, the One Big Beautiful Bill Act, as passed by the House of Representatives on May 22, 2025.

The first policy to be discussed, included in CBO’s baseline, involves the expiration at the end of calendar year 2025 of the expanded structure of the premium tax credit. That expansion was initially authorized by the American Rescue Plan Act of 2021 and extended under the 2022 reconciliation act.

The second arises from a rule proposed in March 2025 by the Department of Health and Human Services (HHS) for the health insurance marketplaces established by the Affordable Care Act (ACA).

The policy changes included in title IV and title XI of H.R. 1 are related to Medicaid and the health insurance marketplaces.

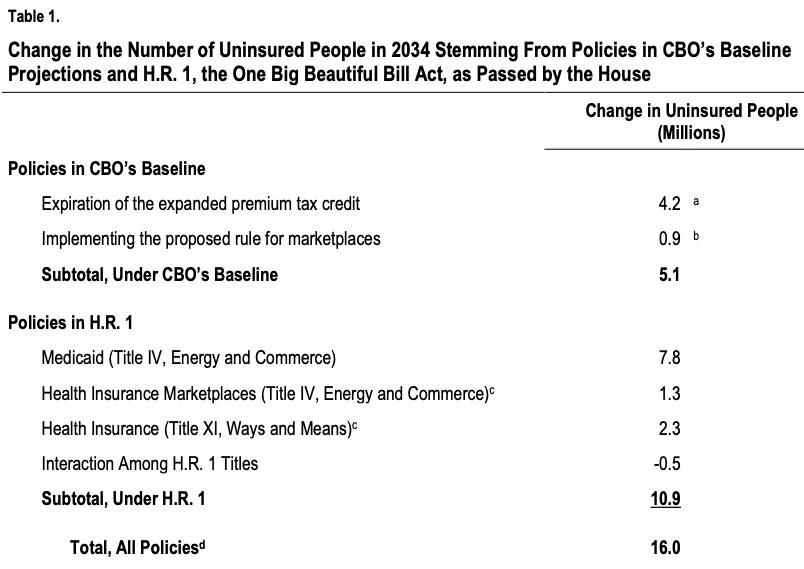

CBO estimates that the combined effects of those policies—two under current law and the others under H.R. 1—would increase the number of people without health insurance by 16.0 million in 2034 (see Table 1). Of that number, about 5.1 million stems from policies incorporated into CBO’s baseline projections and 10.9 million from provisions that would be enacted under H.R. 1.

BOOM. There's the above-the-fold headline: 16 MILLION Americans would become uninsured.

Policies Included in CBO’s Baseline Projections

The expanded premium tax credit as scheduled to expire at the end of 2025, combined with implementing the rule proposed by HHS for the marketplaces, will increase the number of people without health insurance by a total of 5.1 million in 2034, in CBO’s projections.

That estimate is based on a comparison relative to a policy you specified that would permanently extend the expanded premium tax credit beyond the end of this calendar year. It also accounts for half of the full effect of implementing the rule proposed by HHS, which has not been made final. CBO’s approach to estimating the effects of proposed rules is discussed below.

There's several footnotes; the last one is worth a special shout-out:

4. This total includes the estimated 1.4 million people in 2034 whose citizenship, nationality, or satisfactory immigration status is not verified but would be covered under current law in programs funded by states.

You may recall that Iowa GOP Senator Joni Ernst's instantly infamous "We're all going to die!" quip was preceded by her using the GOP talking point that "When you're arguing about illegals that are receiving Medicaid benefits, 1.4 million (people)…they're not eligible so they will be coming off."

It's critically important to understand that these are the 1.4 million undocumented immigrants she's referring to: People who are legally enrolled in healthcare coverage (technically not Medicaid but effectively Medicaid) 100% the cost of which is paid for by the STATES, NOT the federal government.

The #OneBigUglyBill would penalize states like California which choose to pay for healthcare coverage using their own state funds. So much for the "States Rights!" party, amirite?

OK, moving on...

Expiration of the Expanded Premium Tax Credit.

The premium tax credit is an advanceable, refundable credit that reduces enrollees’ out-of-pocket cost for premiums for health insurance obtained through the marketplaces.

That credit is calculated as the difference between the benchmark premium (that is, the premium for the second-lowest-cost silver plan available in a region) and a maximum household contribution that is calculated as a percentage of household income and adjusted over time.

Until 2021, the credit was available to people who met four criteria:

- Their modified adjusted gross income was between 100 percent and 400 percent of the federal poverty level (FPL),

- They were lawfully present in the United States,

- They were not eligible for public coverage, such as Medicaid, and

- They did not have an affordable offer of employment-based coverage.

For 2021 and 2022, the American Rescue Plan Act expanded eligibility to include enrollees whose income was above 400 percent of the FPL and reduced the maximum household contribution. The 2022 reconciliation act extended those provisions through 2025.

You have requested that CBO compare the effects of a policy that would permanently extend the expanded premium tax credit with the scheduled expiration under current law. Relative to a permanent extension, in CBO’s baseline projections, the expiration of the expanded credit will increase by 4.2 million the number of people without health insurance in 2034.

Some of those people will not obtain insurance in the marketplaces because of the higher out-of-pocket costs they will face for premiums. CBO’s baseline projections account for the estimated increase in the number of uninsured people after the expiration of the expanded subsidy structure.

Proposed Rule Related to Marketplaces.

The proposed rule that HHS published in March makes changes, among others, to the open enrollment period, special enrollment periods (SEPs), verification of eligibility for the premium tax credit, out-of-pocket costs for premiums, and how insurers meet requirements related to the costs they pay to cover medical expenses.

CBO estimates that implementing the rule would increase the number of people without health insurance by 1.8 million in 2034. The agency has incorporated 50 percent of that number—the 900,000 people indicated in Table 1—into its baseline projections.

That approach—incorporating half of the estimated effect—is a treatment that CBO developed in consultation with the House and Senate Committees on the Budget to account for the uncertainty surrounding whether a proposed rule will be made final and what form that final rule would take. Once a rule is final, CBO updates its baseline to reflect 100 percent of the estimated budgetary effects.

The primary effects of the proposed regulation, which are described below, reflect the 50 percent baseline treatment.

The other 50% (900,000) are baked into the grand total below.

Enrollment Periods.

CBO estimates that changes to open and special enrollment periods will increase the number of people without health insurance by 300,000 in 2034. Most of that increase—200,000 people—results from states with federally facilitated marketplaces no longer making available the SEP that allows people whose income is 150 percent of the FPL or below to enroll in marketplace coverage at any point during a year.

In CBO’s analysis, the remaining decline of 100,000 people is the result of the rule’s requirement that marketplaces increase verification of eligibility for enrollees who enter during SEPs and the requirement to set the open enrollment period for November 1 through December 15.

Verifying Eligibility for the Premium Tax Credit.

CBO estimates that the changes in the proposed rule regarding eligibility will increase the number of people without health insurance by 300,000 in 2034. Of that effect, 100,000 stems from requiring additional verifications if an applicant’s reported income is unable to be verified in tax data and another 100,000 stems from requiring applicants to submit additional documentation if the available data show income below the FPL (the threshold for eligibility in most cases).

The other reduction—of 100,000 people—stems from prohibiting tax filers from receiving advanced payments of the credit if they received an advanced payment in a previous year but did not reconcile amounts advanced with the actual amount of the premium tax credit they were eligible for at tax filing.

(Under prior practice, advanced payments were prohibited if the filer did not reconcile for two consecutive years.)

Call these "Death by 1,000 Cuts"...no single one of these changes would devastate the ACA exchange market, but combined they add up considerably.

Policies Under H.R. 1

CBO estimates that enacting H.R. 1, as passed by the House, would increase the number of people without health insurance by 10.9 million in 2034, relative to baseline projections under current law.

Proposals in Title IV, Energy and Commerce, Related to Medicaid.

CBO estimates that enacting the Medicaid provisions in title IV would increase the number of people without health insurance by 7.8 million in 2034. Most of that increase would stem from provisions in five sections.

- Requirement for States to Establish Medicaid Community Engagement Requirements for Certain Individuals.

Section 44141 would require states to establish a requirement for certain Medicaid recipients to participate in work-related activities for at least 80 hours per month. Hours spent in employment, in a job‑training program, or performing community service would count toward the monthly minimum. Under the policy, states would lose federal Medicaid funding for able-bodied adults between the ages of 19 and 64 who have no dependents and who fail to meet the requirement.

CBO expects that about 18.5 million people would be subject to the requirement each year, once implemented fully in all states, although some would qualify for an exemption. In 2034, federal Medicaid coverage would decrease by about 5.2 million adults. Few of those disenrolled from Medicaid because of the policy would have access to and enroll in employment-based coverage and none would be eligible for the premium tax credit. CBO estimates that enacting section 44141 would increase the number of people without health insurance by 4.8 million in 2034.

These are the so-called "Work Requirements" which have received so much attention, and which have proven to be expensive disasters in every other instance where they've been implemented...assuming the goal is actually to increase employment and eliminate "waste/fraud/abuse" as opposed to the actual intent of these requirements, which is to kick as many people off the program in order to allow the "savings" to go towards tax cuts for the superrich.

Prohibiting Federal Financial Participation Under Medicaid and CHIP for Individuals Without Verified Citizenship, Nationality, or Satisfactory Immigration Status.

Section 44110 would reduce the federal matching rate for the Medicaid expansion population from 90 percent to 80 percent for any state that uses its own funds to provide coverage to certain immigrants through state programs.

CBO estimates that enacting section 44110 would increase the number of people without health insurance by 1.4 million in 2034 because, in order to maintain the 90 percent federal matching rate, most states would stop using state-only funds to provide health insurance coverage. Those 1.4 million people currently are covered under state-funded programs alone; their health insurance coverage does not involve federal funding.

Boom. As I noted above: The House GOP wants to punish states which choose to provide healthcare coverage to undocumented immigrants at their own expense.

Increasing Frequency of Eligibility Redeterminations for Certain Individuals.

Section 44108 would require states to make new determinations of eligibility every six months for some enrollees. Under current law, redeterminations typically are completed annually. CBO expects that enacting the section would result in some people being removed from the program sooner than would occur under current law. CBO estimates that enacting the change would increase the number of people without health insurance by 700,000 in 2034.

It should be noted that administering "redeterminations" in & of itself is expensive for the states to handle; the bill would basically double the cost of doing so.

Moratorium on Implementation of Rule Relating to Eligibility and Enrollment for Medicaid, CHIP, and the Basic Health Program.

Section 44102 would prevent one part of what is termed the Eligibility and Enrollment final rule from being implemented, administered, or enforced through the end of 2034.

The Centers for Medicare & Medicaid Services issued two final rules, one each in 2023 and 2024, together called the Eligibility and Enrollment final rule. That rule simplifies and standardizes state processing of applications and renewals for coverage under Medicaid and the Children’s Health Insurance Program (CHIP) to reduce administrative burdens and barriers to enrollment.

Enacting the section would reduce enrollment because states would return to their earlier administrative practices. CBO estimates that enacting section 44102 would increase the number of people without health insurance by about 600,000 in 2034. That increase reflects changes in all eligibility categories within Medicaid and CHIP.

Let me repeat that: The Biden Administration implemented changes to simplify & streamline Medicaid/CHIP enrollment to make it easier & more efficient to do so...and the #OneBigUglyBill would deliberately prevent those changes from being implemented.

So much for the "Dept. of Government Efficiency."

Moratorium on New or Increased Provider Taxes.

Section 44132 would prevent states from increasing the rates of existing taxes on providers and bar them from creating new tax arrangements for providers.

Virtually all states finance a portion of their Medicaid spending through taxes collected from health care providers. Those amounts are returned to the providers in the form of higher Medicaid payments, leaving providers at least no worse off for their participation. Federal law effectively allows states to use such arrangements when the taxes they collect do not exceed 6 percent of a provider’s net revenues from treating patients. The higher Medicaid payments increase the contributions from the federal government to state Medicaid programs.

CBO estimates that enacting section 44132 would increase the number of people without health insurance by 400,000 in 2034 because of the expectation that some states would modify their Medicaid programs in response to the reduction in available resources by changing enrollment policies and procedures to make enrollment more challenging to navigate.

The way these provider taxes work sound like they need to be tweaked, but if you're going to prevent them from continuing to do so, it should be done in such a way that no one is kicked off of coverage as a result. How? Well, you could increase the federal matching rate accordingly to make up for the lost revenue from cracking down on these tax arrangements...(yeah, right...)

Other Effects.

CBO estimates that enacting the remaining Medicaid policies under H.R. 1, and the interactions among all of the policies, would, on net, reduce the estimated number of people without health insurance by 100,000 in 2034.

Proposals in Title IV, Energy and Commerce, Related to the Health Insurance Marketplaces.

CBO estimates that enacting the provisions in title IV that are related to the health insurance marketplaces would increase the number of people without health insurance by 1.3 million in 2034. Most of that increase—900,000 people—stems from provisions in section 44201 that would codify the rule proposed in March concerning the marketplaces. (That amount represents the remaining 50 percent of the estimated effects of the proposed rule.) The additional increase in the number of people without health insurance beyond that amount has sources in two sections within title IV.

Funding Cost-Sharing Reductions.

Enacting section 44202 would affect the cost-sharing reductions that the ACA requires insurers to offer to eligible people who purchase silver plans through the marketplaces. Those reductions increase the actuarial value—the average share of covered medical expenses paid by the insurer—above the amount in other silver plans, resulting in lower out-of-pocket costs for eligible enrollees. To be eligible for cost-sharing reductions an enrollee’s income must generally fall between 100 percent and 250 percent of the FPL; the subsidy varies with income.

Before October 12, 2017, the federal government reimbursed insurers for the cost of those reductions through direct payments. After that date, the Administration announced that it would no longer make payments to insurers unless an appropriation was made for that purpose. Because insurers still must offer cost-sharing reductions, and they bear that cost even without a direct payment from the government, most cover the costs by increasing premiums for silver plans offered through the marketplaces. That practice, called silver loading, results in a larger premium tax credit because the credit is tied to the second-lowest-cost silver plan. The credit covers a greater share of premiums for non-silver plans and, in CBO’s estimation, primarily increases enrollment among people with income between 200 percent and 400 percent of the FPL.

I've written about Silver Loading many, many times over the past 7 years or so; here's my latest explainer which ties in with the current #OneBigUglyBill.

Section 44202 would appropriate funds for cost-sharing reduction payments and only allow those payments for plans that limit any coverage of abortion services to when it is necessary to save the life of the mother or the pregnancy is a result of rape or incest. Silver loading would end if insurers were compensated for cost-sharing reductions through an appropriation, thereby reducing gross premiums for silver plans and reducing the premium tax credit.

WHOA. This is actually a highly ironic detail which my friend Louise Norris called attention to; I'll discuss/explain it more below.

In the absence of silver loading, CBO projects, there would be declines in enrollment primarily among people whose income is between 200 percent and 400 percent of the FPL because of the smaller subsidy available to them.

CBO estimates that enacting section 44202 would result in roughly 75 percent of marketplace enrollees living in states where silver loading would end. Because some states mandate coverage of certain abortion services, and marketplace plans still must offer cost-sharing reductions, CBO projects that the other 25 percent of enrollees would live in states where silver loading would continue, consistent with current practices.

In other words, Silver Loading would continue in states which mandate abortion coverage by ACA exchange plans.

And which states would that be?

- California

- Colorado

- Illinois

- Maine

- Maryland

- Massachusetts

- Minnesota

- New Jersey

- New York

- Oregon

- Washington

- Vermont

That's right: Most of the blue states are actually the ones which wouldn't be harmed by this particular provision, while every red & purple state (plus some blue ones) would be hit by it. Surreal, but here we are.

All told, CBO estimates, enacting section 44202 would increase the number of people without health insurance by 300,000 in 2034.

Additional requirements related to special enrollment periods.

Section 44201 would largely codify the marketplace regulations described above, with one primary difference. The SEP for people whose income is 150 percent of the FPL or below would be removed from all marketplaces. Under regulations published in 2024, those people may enroll in marketplace coverage at any point during a year. (In CBO’s assessment, the proposed marketplace rule removes such a SEP only for federally facilitated marketplaces; section 44201 would remove the SEP from state-based marketplaces as well.) CBO estimates that expanding the requirement to state-based marketplaces would increase the number of people without health insurance by 200,000 in 2034.

I've actually always been a little iffy on whether the < 150% FPL year-round SEP is reasonable to keep if the IRA subsidies are ending anyway since the entire point of having a limited-time Open Enrollment Period (OEP) is to prevent people from gaming the system, but it's still not a good thing to kick 200,000 people out of coverage.

Proposals in Title XI, Ways and Means, Related to Health Insurance Coverage.

CBO estimates that enacting provisions in title XI related to health insurance coverage would increase by 2.3 million the number of people without health insurance in 2034.

Immigration Provisions.

Part 2 of subtitle C contains two sections that would restrict eligibility for the premium tax credit for certain immigrants. Under current law, lawfully present immigrants are eligible for the premium tax credit if other eligibility criteria are met. Enacting section 112101 would remove eligibility for immigrants in the following categories:

- People with pending asylum applications, those who have been granted asylum, and parolees;

- People with temporary protected status and those granted deferred action, including recipients under Deferred Action for Childhood Arrivals (DACA);

- People granted statutory withholding of removal;

- Temporary workers;

- Nonimmigrants (including student exchange visitors and others admitted as nonimmigrants under the Immigration and Nationality Act);

- Trafficking victims and refugees; and

- Cuban and Haitian entrants.

CBO estimates that enacting section 112101 would increase the number of people without insurance by 1.0 million in 2034.

That's right: House Republicans want to screw over HUMAN TRAFFICKING VICTIMS.

I'm not even sure I have the words to express how sickening that is.

Under current law, people whose income at the time of application for insurance coverage is below 100 percent of the FPL are ineligible for the premium tax credit, with one area of exception. Immigrants who are deemed by regulation to be lawfully present, but whose income is below 100 percent of the FPL, may receive a premium tax credit if they do not have access to Medicaid because of their immigration status; they must also meet other eligibility criteria.

Section 112102 would remove eligibility for the premium tax credit for people whose income is below 100 percent of the FPL. CBO estimates that enacting section 112102 would increase the number of people without insurance by 300,000 in 2034.

Documented immigrants aren't eligible for Medicaid until they've been living in the U.S. for at least 5 years. The exception above was originally included specifically to prevent low-income recently-arrived immigrants from being screwed both ways (ie, neither eligible for Medicaid nor for ACA subsidies). The #OneBigUglyBill would remove that exception & screw them.

Provisions Related to Verification and Enrollment Periods in the Marketplaces.

CBO estimates that enacting part 3 of subtitle C would increase the number of people without health insurance.

Section 112201 would establish new verification requirements for determining eligibility for the premium tax credit. Those requirements would be in addition to requirements in the rule proposed by HHS prohibiting people from receiving advanced payments of the premium tax credit if they have not reconciled a prior year’s advanced payments at tax filing.

Enacting section 112201 would disqualify people for the advanced premium tax credit until their income, immigration status, health coverage status or eligibility, place of residence, family size, and any other information determined by the Secretaries of the Treasury and Health and Human Services are verified. Verification would be required for people newly enrolling or reenrolling in coverage during open enrollment and for people newly enrolling in coverage during SEPs.

The advanced premium tax credit would not be available while applicants are awaiting verification. Section 112201 does not specify whether people would be required to pay the entire gross premium while awaiting verification. It also does not specify whether their enrollment could be put on hold, allowing them to pay net premiums retroactively (that is, to pay the premium minus the advanced premium tax credit) for previous months if their verification is successful.

Using information about past implementation practices for SEPs, CBO expects a high likelihood that people would not have to pay the entire gross premium and would instead have their enrollment placed on hold. As a result, CBO estimates that the largest effect of enacting the policy would result from a decrease in reenrollment each year because enrollees would now need to at least actively affirm their eligibility rather than become automatically reenrolled. CBO estimates that enacting section 112201 would increase the number of people without health insurance by 700,000 in 2034.

Enacting section 112202 would make the premium tax credit unavailable if in state- and federally facilitated marketplaces the credit was associated with the SEP for people whose income is 150 percent of the FPL or below, allowing them to enroll in coverage at any point during a year. Given that people enrolling under such SEP receive large subsidies under current law, CBO estimates that enacting the section would effectively eliminate this SEP. CBO estimates that enacting section 11202 would increase the number of people without health insurance by 400,000 in 2034.

Other Effects. CBO estimates that enacting the remaining policies in title XI, and the interactions among those policies, would, on net, reduce the number of people without health insurance by 100,000 in 2034.

Interactions Among Titles

CBO estimates that the interactions among several titles in H.R. 1 would reduce the number of people without health insurance by 500,000 in 2034. The interactions are primarily among provisions in title IV and title XI, including the elimination of the SEP in state- and federally facilitated marketplaces that allows people whose income is 150 percent of the FPL or below to enroll in coverage at any point during a year.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.